5. What do price patterns indicate?

6. Which is the most popular reversal patterns?

7. What role does volume play with Head and Shoulders patterns?

8. Compare Double Top and Rounding Top patterns.

Exercises

Ex. 1. Put questions to the underlined words.

Ex. 2. Compare the reversal patterns and state their difference.

Ex. 3. Translate the dialogue from English into Russian in writing and from Russian into English orally.

Dialogue:

Client: What are the prerequisites of reversal patterns?

Broker: A prerequisite for any reversal pattern is the presence of a trend. A break in the trend line usually

accompanies a reversal pattern. The lai-ger the pattern, the greater the significance. CI: When does a retest in the Right Shoudler take place? Br: A retest is always a retest of the climax whether it be a top or a bottom. CI: What are the conditions for a retest of a climax?

Br: In a trending market there must be a rally. Market has a sharp turn down. New buyers start buying. CI: And the new buyers are not enthusiastic. Br: No, they are not. Declining volume and trading range confirm that. CI: When is the retest complete?

Br: The retest is complete if the buyers falter within the 50% region of the climax retest and price turns sharply down. A retest does not require the trader to wait for a break of the previous low pivot point.

TRANSLATION PRACTICE

New Concepts in Support and Resistance

Fig. 1

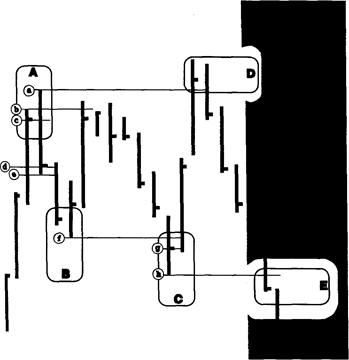

| There is an understandable tendency to look to see kev horizontal support and resistance levels tested when they are reapproached. Many traders tend to set profit targets referenced to such levels, and stops also tend to be positioned relative to breaches of these levels. This is all verv well but disappointment often results as the key support and resistance levels in a structure aren't necessarily the isolated highs and lows. Thus very often the market will reverse just short of these levels, much to the fury of many traders who'd been counting the pennies before they were securely in the till! Consider the stylised bar chart in figure 1, areas (A) and (B) represent a two period reversal stmcture that is commonly seen in the markets. Taking the highlighted (A) area first, the bulls would have been well contented at the close of the period (close "C"). However, they were due for a shock, as whilst the market did push higher to begin with in the next period (sucking more weakly committed bulls in), by the close (close "D") there were a lot of unhappy and damaged traders around. The high of the first period "b" constitutes a much more potent resistance level when retested, than the actual isolated high of the structure marked "a". This is not to say that "a" won't be attacked, but time and again you'll find it's "b" where the real battle is fought, and where the subsequent reversal or | Vocabulary to set targets — ставить цели ja fury — бешенство till — касса л to suck in — всасывать ou 'potent - сильный |

| consolidation will be initiated. In the practical sense one could say "b" is more significant than "a" due to a greater degree of market confidence at "b", and it is almost certainly associated with higher volume. There is however another way of looking at it, which I call the "Concept of Maximum Bearishness/Bullishness". Maximum Bearishness/Bullishness If in the first highlighted period of (A) the bulls had been totally in control, with the bears utterly routed, then the close of the period would have been at "b", the period high. One can look at this pullback from the high — the difference between "b" and "с" — as representing the ability of the bears to fight back. Similarly in the second oeriod of (A) the orice difference between "d" and "e" represents the ability of the bulls to fight back after being mauled. The way to evaluate which is the period of maximum bullish strength in any structure (which is where the bulls had maximum control) is to sweep back these differences (the pullback from the high) through the respective closes and compare the levels obtained. This is the concept of SWEEP and it is the period with the highest sweep level that constitutes maximum bullishness. The high of this maximum bullish period is a key resistance. I think it can be easily seen that reflecting "b"—"c" back through "c" gives a much higher level than reflecting "a"—"d" back through "d". Thus it's the first period of (A) and its high "b" that qualifies as the maximum bull point not point "a", despite it being higher. Note the maximum bull period may indeed be the one that includes the actual isolated high (area (D) is such an example). Resistance Level Strength Price action as depicted in (A), being a two period bull reversal structure, needs to be viewed in light of the above if, or when, the market returns to the same level. There are a couple of tests that can be applied to make a judgement on how potent the resistance level "b" is likely to prove: 1. Reflect the "sweep" movement of the price curve points "b"-"c" down through "c" and "d"-"t" up through "d". Do the two levels cross or are they able to "hold hands" as I term it? If they do not, it's a measure of how many people have been caught and how badly they've been caught. It is the pain and distress that materialises from a reversal level that directly and strongly influences how potent it will prove at a later time. If the reversal was violent, closing on or near the low of the period and thereby giving the majority in a bad position little or no time to get out, then "b" will return to "haunt" the market if the level is re—attained — pain is remembered even if only subconciosly! 2. Look at the price action following the reversal period, did it make a fair job of re-tracing before going down again, or did the market just plummet? If it's the former then "b" won't be nearly so key a level than if we get a nose dive. Again it comes back to giving traders an opportunity to get out when wrong without a serious loss. Remember a violent one-way market means somebody somewhere is in distress! | au |

| to rout — разгромить | |

| о: | |

| to maul — калечить, бить | |

| to hold hands — занимать выжидательную | |

| политику | |

| e distress — горе | |

| pain — боль | |

| О' . | |

| 'to haunt - преследовать | |

| л | |

| to 'plummet — резко упасть | |

Exercises

Ex. 1. Put questions to the underlined words.

Ex. 2. Find verbal constructions and state their syntactical function in the sentence.

Ex. 3. Select sentences which present difficulties for translation and make a syntactical analysis of them.

Ex. 4. Draw up a plan of the article.

Ex. 5. Enact an imaginary dialogue between the author and a dealer on support and resistance.