4. What are the basic principles of traditional Technical Analysis?

5. How does history repeat itself?

6. Why do markets discount everything?

7. What approaches in forecasting yield good results?

8. By what events are markets driven now?

9. What precede upcoming political and economic events?

10. What saying reflects this process?

11. In what way do central banks influence financial markets?

12. How are the weaknesses of fundamental analysis complemented?

13. What are the guidelines that newcomers to forecasting should observe?

Exercises

Ex.1. Learn the terms and verb collocations and make up 20 sentences with them.

to agree about the price to produce a fair value to strengthen (to weaken) to run into selling pressure (buying interest) to grow in popularity to be reflected in the price to reflect shifts in Supply, and Demand to gauge changes in trend to be based on psychology to work in the past to lie in the past to estimate future direction to identify patterns to ride the rising trends to show signs of a reversal to discount everything to capture market sentiment to implement a trading plan to use technical approaches to be in agreement with

Ex. 2. Put questions to the underlined words in the text and let your partner answer them.

Ex. 3. Select the subordinate clauses and state of what kind they are (object clause, attributive clause

adverbial modifier clause of time, place, cause, etc.)

Ex. 4. Read and translate the text.

Ex. 5. Draw up a plan of the text and render it.

Comprehension Questions

1. Who produces the fair value of the currency?

2. Why do currency prices fluctuate?

3. What is the technician's challenge?

4. What are the basic principles of traditional Technical Analysis?

5. How does history repeat itself?

6. Why do markets discount everything?

7. What approaches in forecasting yield good results?

8. By what events are markets driven now?

9. What precede upcoming political and economic events?

10. What saying reflects this process?

11. In what way do central banks influence financial markets?

12. How are the weaknesses of fundamental analysis complemented?

13. What are the guidelines that newcomers to forecasting should observe?

Exercises

Ex.1. Learn the terms and verb collocations and make up 20 sentences with them.

to agree about the price to produce a fair value to strengthen (to weaken) to run into selling pressure (buying interest) to grow in popularity to be reflected in the price to reflect shifts in Supply, and Demand to gauge changes in trend to be based on psychology to work in the past to lie in the past to estimate future direction to identify patterns to ride the rising trends to show signs of a reversal to discount everything to capture market sentiment to implement a trading plan to use technical approaches to be in agreement with

Ex. 2. Put questions to the underlined words in the text and let your partner answer them.

Ex. 3. Select the subordinate clauses and state of what kind they are (object clause, attributive clause

adverbial modifier clause of time, place, cause, etc.)

Ex. 4. Read and translate the text.

Ex. 5. Draw up a plan of the text and render it.

| MARKET STAGES

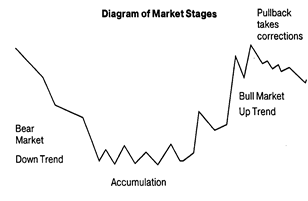

Traditionally markets move from Bull markets to Sideways markets to Bear markets. They move from Bear to Sideways to Bull. People however tend to forget the sideways market stage and assume that markets move from Bear to Bull, to Bear. The only markets that do in fact move from Bull to Bear are the exceptions and not the rule — they are parabolic markets and are usually characterised by thin trading volumes. Traditionally speaking, the market stages can be sum marized as follows: Ø Markets accumulate — go sideways at the end of a down trend Ø Markets then trend up, trending up they have a correction or a pause Ø Markets then climax or peak Ø Markets accumulate (distribution — sideways movement at the top) Markets trend down | |

| Vocabulary | |

| 0: | |

| accordingly - соответственно | |

| au | |

| to'counter — выдвигать контраргумент | |

| time frames — временные рамки | |

| i | |

| to anticipate — предвосхищать | |

| e | |

| exception - исключение |

| о volume | — объем |

| to apply | — применять, использовать |

| (to be) due | — ожидаемый, обусловленный |

| ei |

| A trader does not sell just because the market has been in an up trend for a long time and a change is due. Before you sell, you at least need to see a sideways move in the market. Technical Analysis is applied to markets because: 1. Markets have stages. 2. Within the stages, there are behavioural characteristics. 3. Within the behavioural characteristics, you have specific patterns. There exist three types of market trends: 1. Up Trend 2. Down Trend 3. No Trend—Congestion | behavioural i sophisticated э 'option | — поведенческий — сложный — опцион |

Comprehension Questions

1. What market stages do you know?